Use cases

This section describes the uses cases that can be supported by this version of the Standard RippleNet Payment Object - Supporting Information. These use cases are not mandatory and a RippleNet member can decide which use cases they wish to support.

Please note the currencies shown in the use cases are shown as examples only.

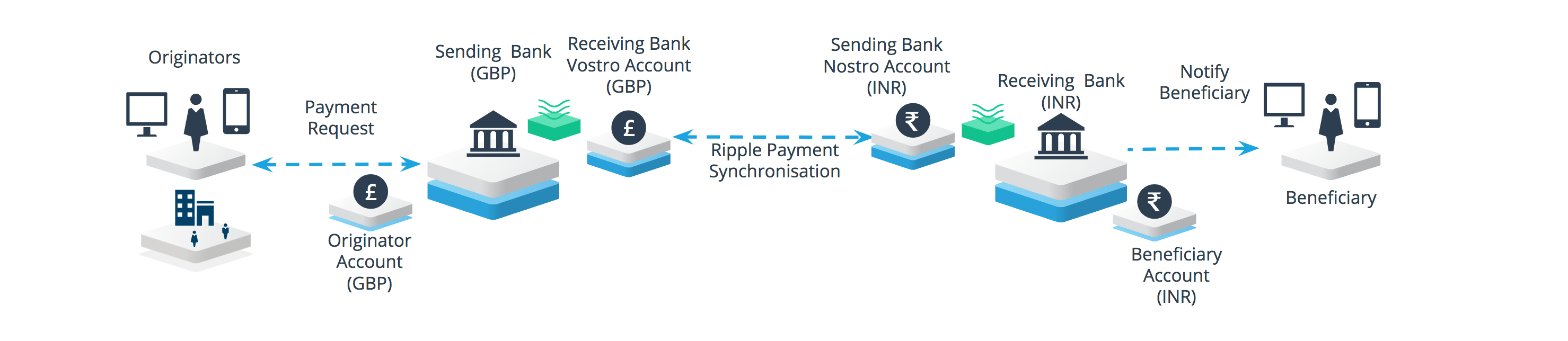

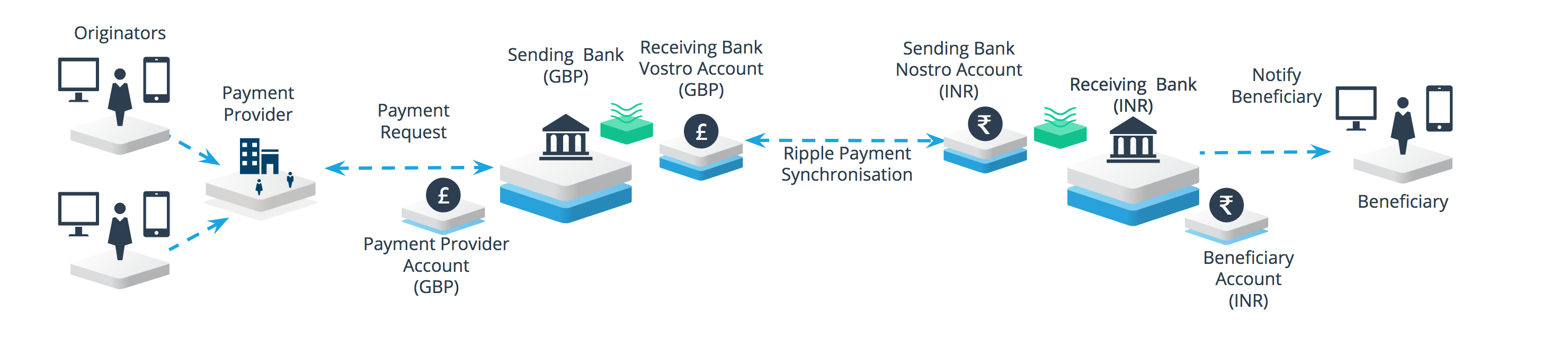

Use case 1

Account with sending bank to account with receiving bank

- Originator account is held by the sending bank who is Ripple-connected

- Beneficiary account is held by the receiving bank who is Ripple-connected

- There should be sufficient information in the RippleNet Payment Object to allow the receiving bank to perform their due diligence

- The receiving bank must be able to credit the beneficiary from the information in the RippleNet Payment Object (including any required domestic codes)

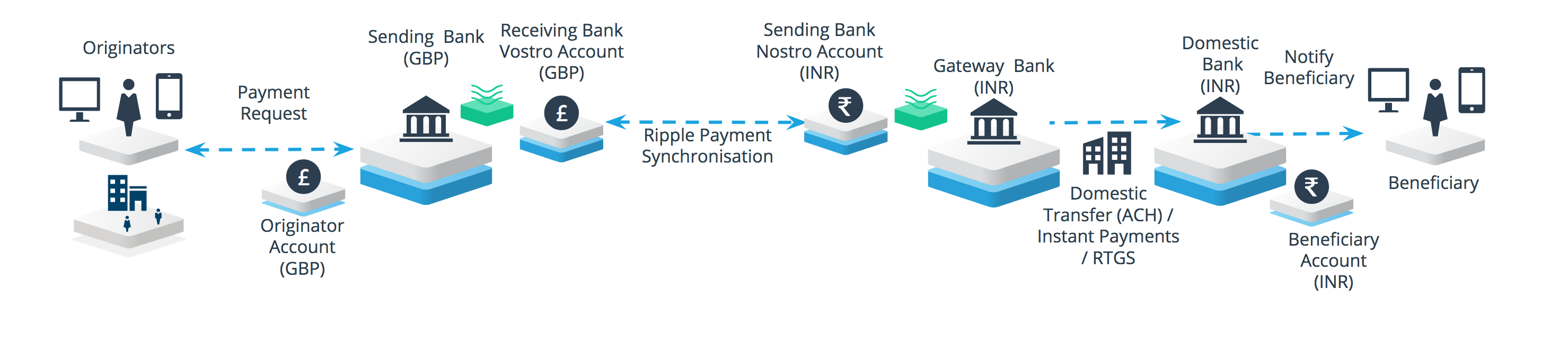

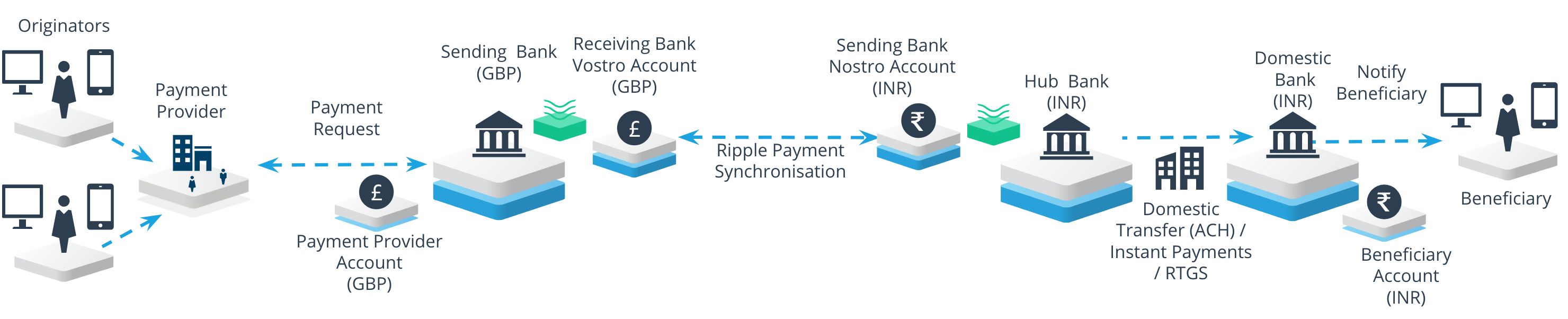

Use case 2

Account with sending bank to account with non Ripple-connected bank

- Originator account is held by the sending bank who is Ripple-connected

- Hub bank is Ripple-connected and acting as a gateway into a specific country

- Beneficiary account is held by the domestic bank (non Ripple-connected bank)

- There should be sufficient information in the RippleNet Payment Object to allow the hub bank to perform their due diligence

- The hub bank must be able to forward the payment to the account at the domestic bank (local ACH / domestic requirements) from the information in the RippleNet Payment Object (including any required domestic codes)

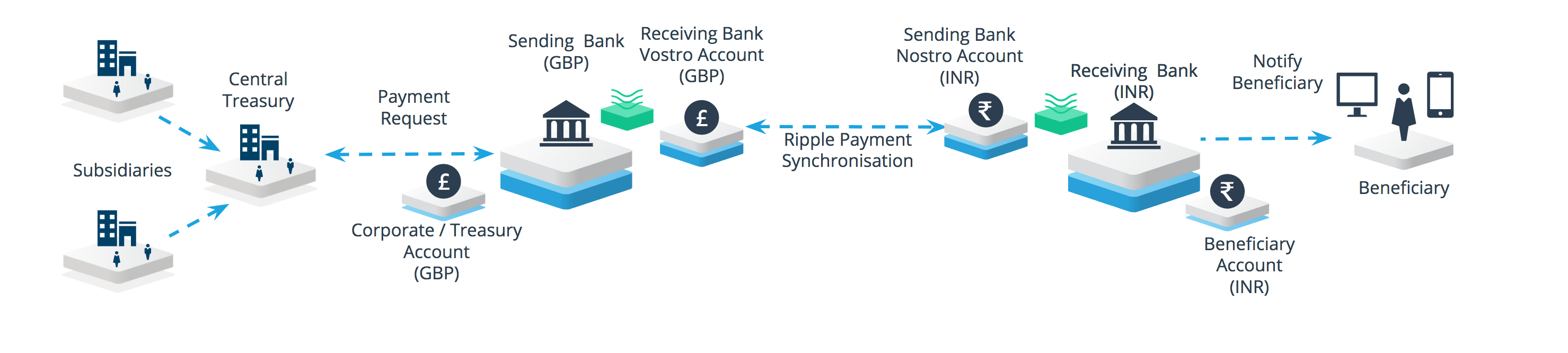

Use case 3

Account with sending bank held by Central Treasury making payments for their subsidiaries to account with receiving bank

- Originator account for the Central Treasury function is held by the sending bank who is Ripple-connected

- The treasury function is paying on behalf of their subsidiaries.

- Beneficiary account is held by the receiving bank (Ripple-connected bank)

- There should be sufficient information in the RippleNet Payment Object to allow the receiving bank to perform their due diligence (including who is the ultimate originator of the payment)

- Requirement to ensure the receiving bank can credit the payment to the beneficiary from the information in the RippleNet Payment Object (including any required domestic codes)

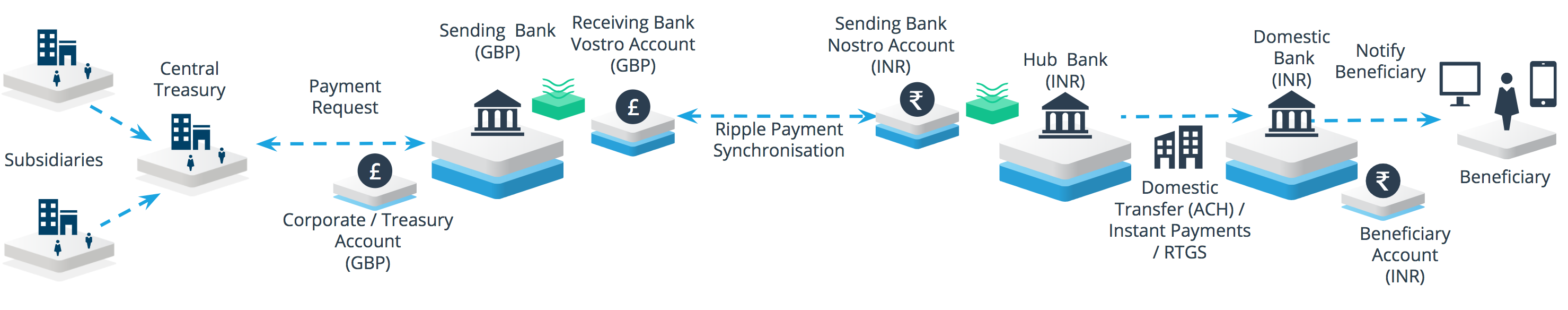

Use case 4

Account with sending bank held by Central Treasury making payments for their subsidiaries to account with non Ripple-connected bank

- Originator account for the Central Treasury function is held by the sending bank who is Ripple-connected

- The Treasury function is paying on behalf of their subsidiaries

- Hub bank is Ripple-connected and acting as a gateway into a specific country

- There should be sufficient information in the RippleNet Payment Object to allow the hub bank to perform their due diligence (including who is the ultimate originator of the payment)

- Beneficiary account is held by the domestic bank (non Ripple-connected bank)

- Requirement to ensure the hub bank can forward the payment to the domestic bank (local ACH / domestic requirements) from the information in the RippleNet Payment Object (including any required domestic codes)

Use case 5

Account with sending bank held by payment provider making payments for their customers to account with receiving bank

- Originator account for the payment provider is held by the sending bank who is Ripple-connected

- The payment provider is paying on behalf of their customers

- Beneficiary account is held by the receiving bank (Ripple-connected bank)

- There should be sufficient information in the RippleNet Payment Object to allow receiving bank to perform their due diligence (including who is the ultimate originator of the payment)

- Requirement to ensure receiving bank can credit the payment to the Beneficiary from the information in the RippleNet Payment Object (including any required domestic codes)

Use case 6

Account with sending bank held by payment provider making payments for their customers to account with non Ripple-connected bank

- Originator account held by the payment provider at the sending bank who is Ripple-connected

- The payment provider is paying on behalf of their customers

- Hub bank is Ripple-connected and acting as a gateway into a specific country

- There should be sufficient information in the RippleNet Payment Object to allow hub bank to perform their due diligence (including who is the ultimate originator of the payment)

- Beneficiary account is held by the domestic bank (non Ripple-connected bank)

- Requirement to ensure hub bank can forward the payment to the domestic bank (local ACH / domestic requirements) from the information in the RippleNet Payment Object (including any required domestic codes)

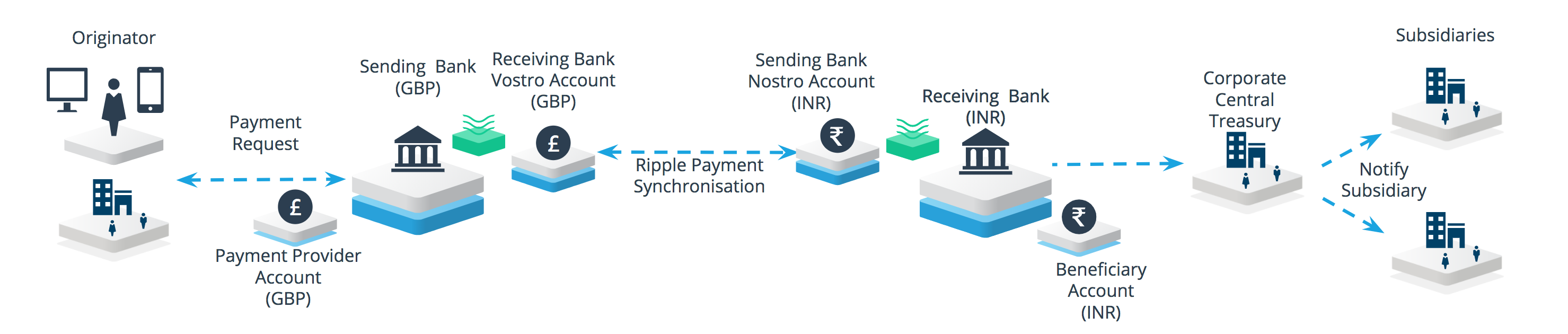

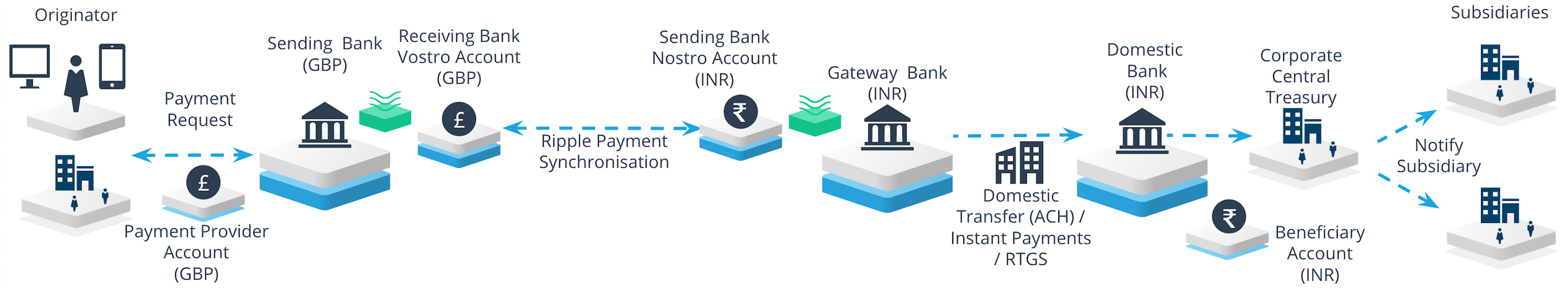

Use case 7

Account with receiving bank held by Corporate Central Treasury receiving payments for their Subsidiaries

- Originator account is held by the sending bank who is Ripple-connected

- The Originator is sending the payment to the Central Treasury function who is collecting the payment on behalf of their subsidiaries

- The sending bank needs to perform their due diligence (including who is the ultimate receiver of the payment)

- Beneficiary account is held by the receiving bank (Ripple-connected bank)

- There should be sufficient information in the RippleNet Payment Object to allow the receiving bank to perform their due diligence (including who is the ultimate receiver of the payment)

- Requirement to ensure the receiving bank can credit the payment to the Central Treasury’s account from the information in the RippleNet Payment Object (including any required domestic codes)

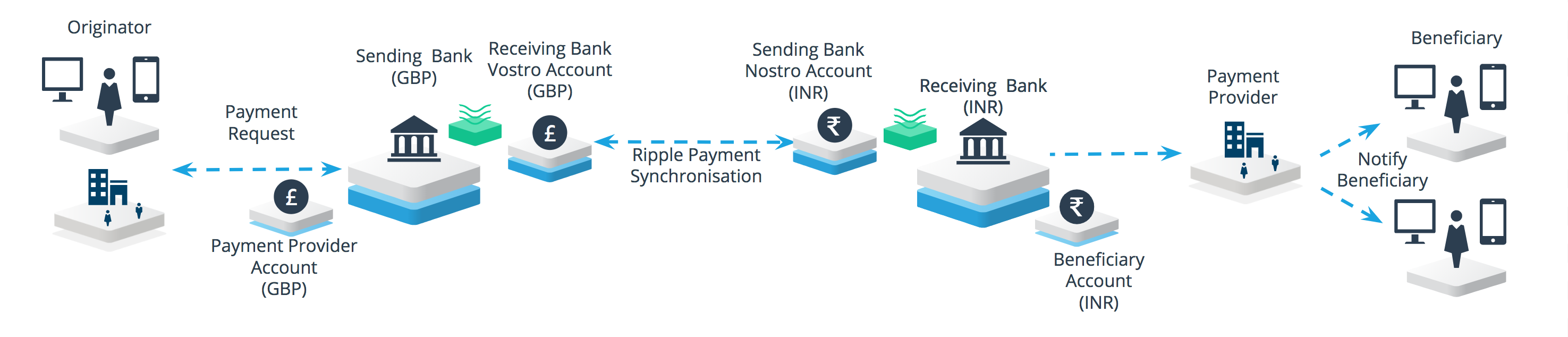

Use case 8

Account with receiving bank held by payment provider receiving payments for their customers

- Originator account is held by the sending bank who is Ripple-connected

- The Originator is sending the payment to the payment provider who is collecting the payment on behalf of their customers

- The sending bank needs to perform their due diligence (including who is the ultimate receiver of the payment)

- Beneficiary account is held by the receiving bank (Ripple-connected bank)

- There should be sufficient information in the RippleNet Payment Object to allow the receiving bank to perform their due diligence (including who is the ultimate receiver of the payment)

- Requirement to ensure the receiving bank can credit the payment to the payment provider from the information in the RippleNet Payment Object (including any required domestic codes)

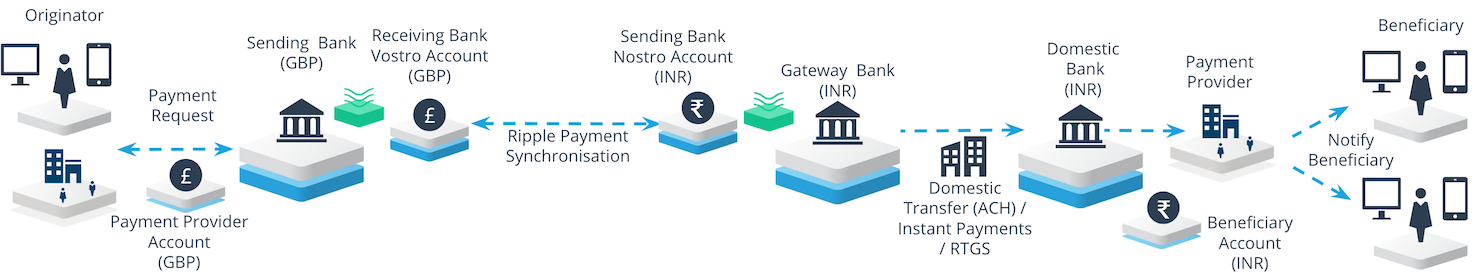

Use case 9

Account with a domestic bank held by Corporate Central Treasury receiving payments for their subsidiaries

- Originator account is held by the sending bank who is Ripple-connected

- The Originator is sending the payment to the Central Treasury function who is collecting the payment on behalf of their subsidiaries

- The sending bank needs to perform their due diligence (including who is the ultimate receiver of the payment)

- Beneficiary Account is held by the domestic bank (non Ripple-connected bank)

- There should be sufficient information in the RippleNet Payment Object to allow the Gateway Bank to perform their due diligence (including who is the ultimate receiver of the payment)

- Requirement to ensure the Gateway Bank can forward the payment to the domestic bank (local ACH / domestic requirements) from the information in the RippleNet Payment Object (including any required domestic codes)

- Requirement to ensure the domestic bank can credit the payment to the Central Treasury’s account from the information in the RippleNet Payment Object (including any required domestic codes)

Use case 10

Account with a domestic bank held by payment provider receiving payments for their customers

- Originator account is held by the sending bank who is Ripple-connected

- The Originator is sending the payment to the payment provider who is collecting the payment on behalf of their customers.

- The sending bank needs to perform their due diligence (including who is the ultimate receiver of the payment)

- Beneficiary account is held by the domestic bank (Non Ripple-connected bank)

- There should be sufficient information in the RippleNet Payment Object to allow the Gateway Bank to perform their due diligence (including who is the ultimate receiver of the payment)

- Requirement to ensure Gateway Bank can forward the payment to the domestic bank (local ACH / domestic requirements) from the information in the RippleNet Payment Object (including any required domestic codes)

- Requirement to ensure the domestic bank can credit the payment to the Central Treasury’s Account from the information in the RippleNet Payment Object (including any required domestic codes)