Reports

The Reports page allows you to view and download Payment Operation reports and invoices for your payments. You can also create customized reports for payment operations. For more information, see the following sections.

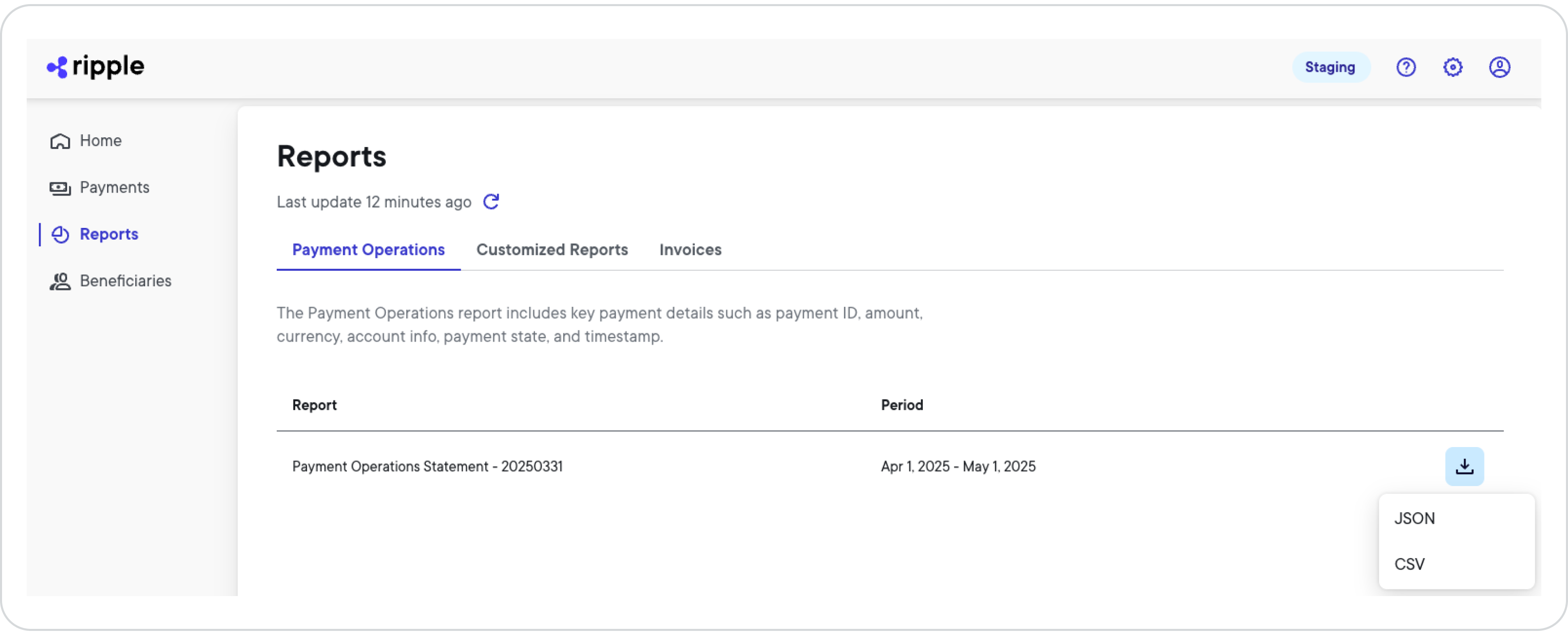

Payment Operations

The Payment Operations tab on the Reports page displays a list of scheduled Payment Operation reports and information about each report. On this tab you can also download a Payment Operations report as a JSON or CSV file.

Payment Operations reports list

Each column in the Payment Operations reports list provides specific information about the payment operations report.

| Column | Description |

|---|---|

| Report | The name and number assigned to the report when it was created. The number usually represents the date that the report was created. For example 20240714 indicates that the report was created on July 14th, 2024. |

| Period | The time period for the payments covered in this Payment Operations report. |

|

Click to download the Payment Operations report in JSON or CSV file format, or both, if available. |

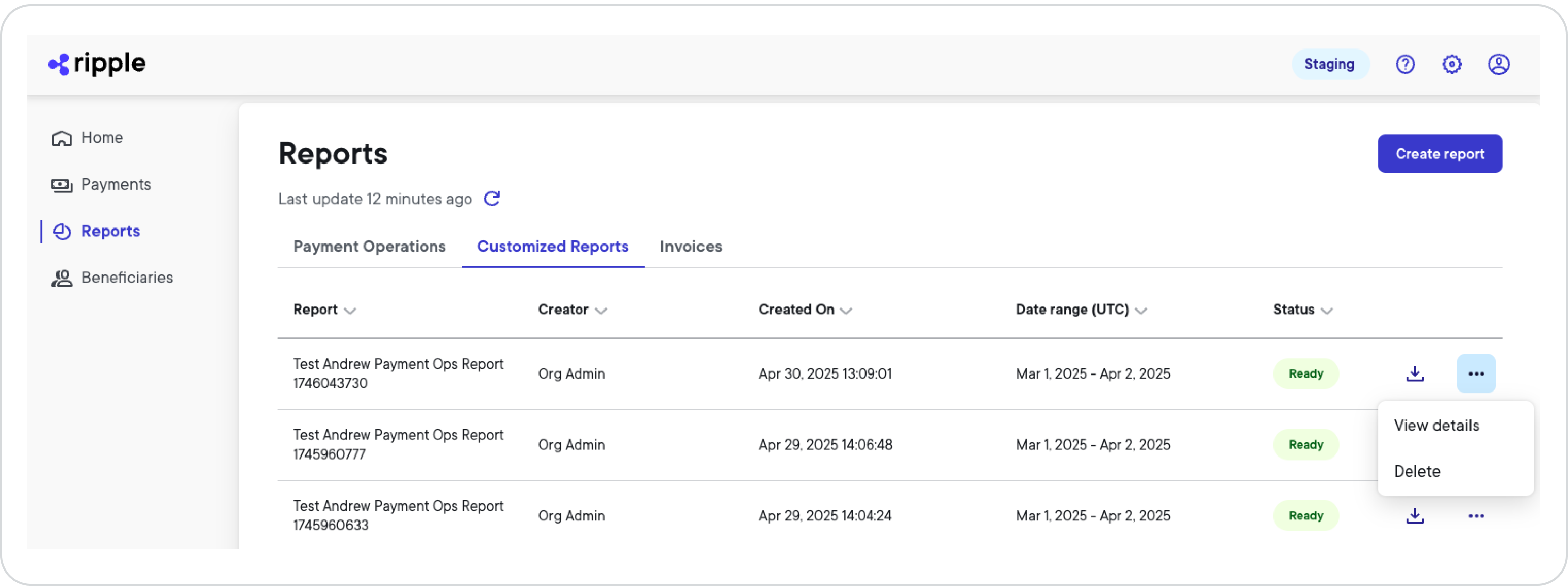

Customized Reports

The Customized Reports tab on the Reports page displays a list of customized reports you created and information about each report. On this tab you can also download a customized report as a JSON or CSV file.

Customized Reports list

Each column in the Customized Reports list provides specific information about the report.

| Column | Description |

|---|---|

| Report | The unique name you assigned to the report. |

| Creator | The user name of the person who created the report. |

| Created on | The date and time (in UTC) when the report was created. |

| Date range (UTC) | The time period for the payments covered in this report. |

| Status | The report status indicating whether the report is |

(if available) |

Download the report in JSON or CSV format, depending on which report format you selected when you created the report. |

|

Click to select from more actions: |

Create customized report

To create a customized report, complete the following steps:

- From the left navigation, select Reports and then click Create report .

- In the Report Name field, enter a unique name for your report.

- Select the Payment Operations report type.

-

Click the

UTC date range

field and from the calendar select the date range for which you want to see report data.

Note

You can only select from a date range within the past 90 days counting backwards from the time when you create the report. Reports older than 90 days get purged and are no longer accessible.

- In the Report Format field, select either CSV or JSON format for your report.

- Click Create Report .

Once your report is generated, you'll be able to select and download it from the reports list.

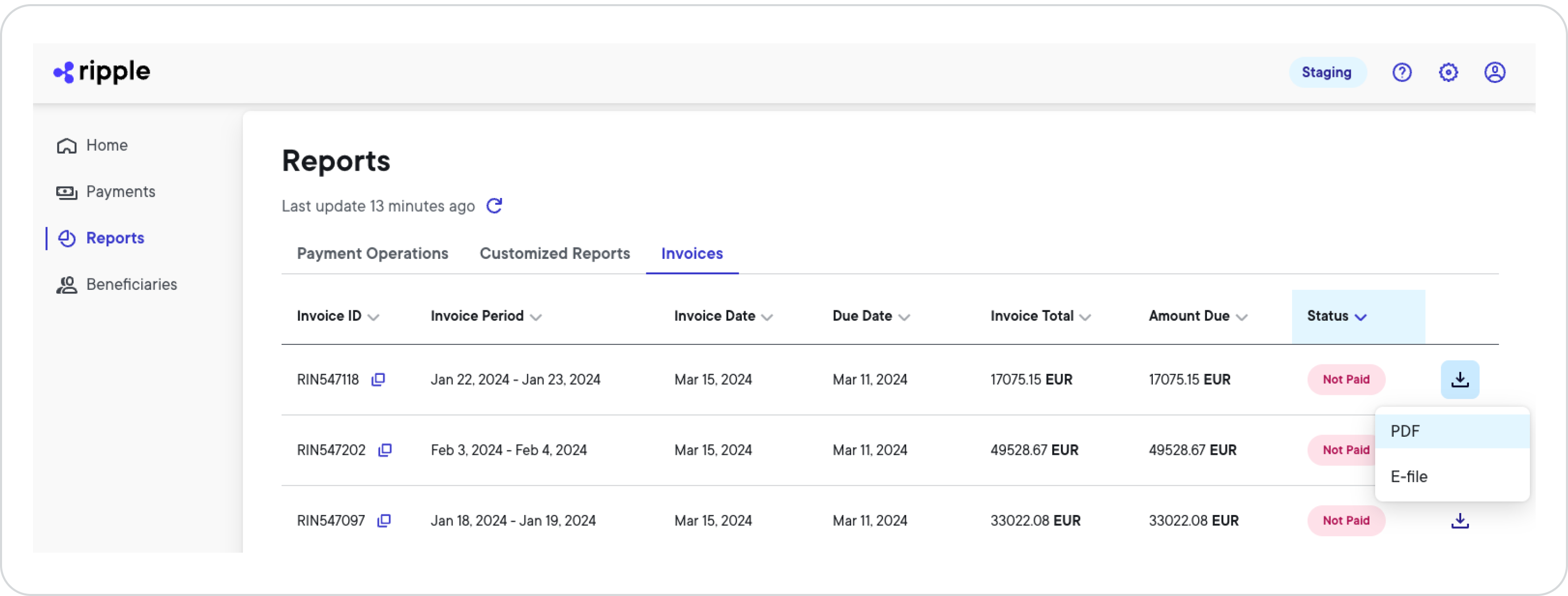

Invoices

The Invoices tab on the Reports page displays a list of invoices and information about each invoice, such as the invoice status (paid, partially paid, or not paid). On this tab you can

-

Download an invoice as a

PDF

file.

In certain cases, you can also download the invoice as an e-file (CSV file format). - Sort the invoices by different columns.

- Copy the invoice ID.

Invoices list

Each column in the invoices list provides specific information about the invoice. Click the column name to sort the invoices accordingly.

| Column | Description |

|---|---|

| Invoice ID |

The unique ID assigned to the invoice when it was created. To copy the invoice ID, click the copy icon next to the ID. |

| Invoice Period | The time period for the payments covered in this invoice. |

| Invoice Date | The date when the invoice was created. |

| Due Date | The date when the total invoice amount is due. |

| Invoice Total | The total amount of the invoice. |

| Amount Due | The amount due. This can be either the total amount or a partial amount depending on the invoice's Status. |

| Status | The invoice status indicating whether the invoice has been 0 |

|

Click to download the invoice in either PDF or e-file format. |

Note

For questions or concerns about an invoice, contact your Ripple liaison.

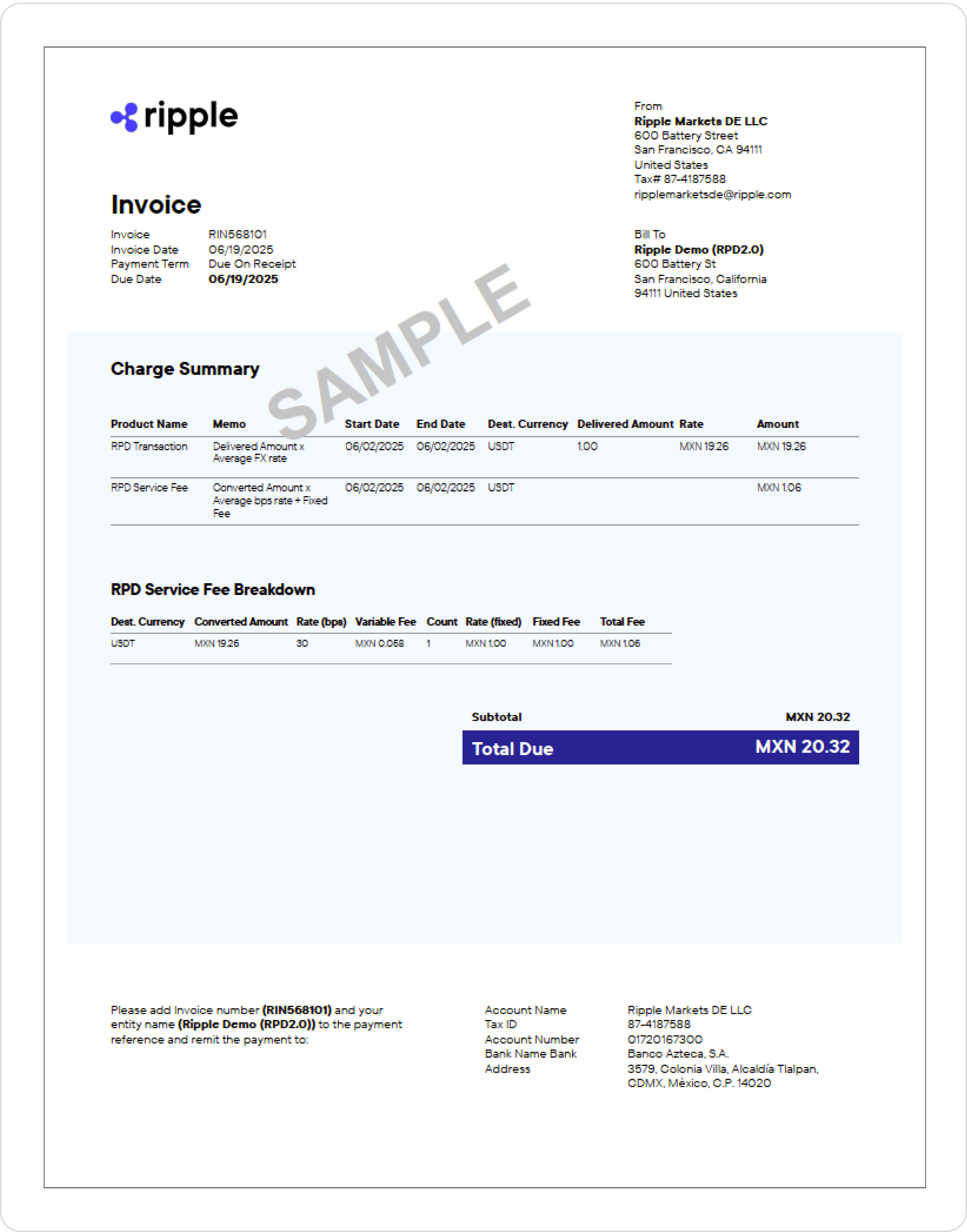

PDF invoice

The upper left side of the PDF invoice shows the following information:

-

Invoice

ID, for example

RIN568101 -

Invoice Date

using the

MM-DD-YYYY

format, for example

06/19/2025 -

Payment Term

specifying the due date terms of the invoice, for example

Due On Receipt -

Due Date

using the

MM-DD-YYYY

format, for example

06/19/2025

The upper right side of the PDF invoice shows the following information:

- Name, address, tax ID, and e-mail address of the invoicer

- Name and address of the invoicee

The middle of the PDF invoice shows the Charge Summary which includes the following information:

Click to expand Charge Summary table

| Column | Description | Example |

|---|---|---|

| Product Name | The name of the product item. | RPD Transaction |

| Memo | A note for the product item. Usually, the memo describes how Amount is calculated. |

Delivered Amount x Average FX rate |

| Start Date | The first day of usage for the product item(s) covered in the invoice using the MM/DD/YYYY format. | 06/02/2025 |

| End Date | The first day of usage for the product item(s) covered in the invoice using the MM/DD/YYYY format. | 06/02/2025 |

| Dest. Currency | The destination currency of the RPD Transaction product item. |

USDT |

| Delivered Amount | The Dest. Currency amount delivered to the beneficiary. | 1.00 |

| Rate | The rate of one RPD Transaction product item (destination Currency). For example, 1 USDT = 19.26 MXN. |

MXN 19.26 |

| Amount | The amount of the RPD Transaction product item, calculated by multiplying Delivered Amount with Rate. |

MXN 19.26 |

The bottom of the PDF invoice shows the RPD Service Fee Breakdown which includes the following information:

Click to expand RPD Service Fee Breakdown table

| Column | Description | Example |

|---|---|---|

| Dest. Currency | The destination currency of the RPD Transaction product item. |

USDT |

| Converted Amount | The amount converted to Dest. Currency. | MXN 19.26 |

| Rate (bps) | The rate in bps applied towards the Converted Amount. | 30 |

| Variable Fee | The variable fee for the RPD Transaction product item. The variable fee is calculated as Converted Amount (here MXN 19.26) x Rate (bps) (here 0.3%) and varies by payout corridor. |

MXN 0.058 (rounded) |

| Count | The amount of RPD Transaction product items necessary to complete Delivered Amount. |

1 |

| Rate (fixed) | The fixed price of one RPD Transaction product item. |

MXN 1.00 |

| Fixed Fee | The fixed fee for the RPD Transaction product item. The fixed fee is calculated as Count (here 1) X Rate (fixed) (here MXN 1.00). |

MXN 1.00 |

| Total Fee | The total fee for the RPD Transaction product item. The total fee is calculated as Variable Fee (here MXN 0.058) + Fixed Fee (here MXN 1.00) |

MXN 1.06 (rounded) |

Sample PDF invoice

The following image shows a sample PDF invoice.

E-file invoice

The e-file invoice comes as a CSV file, which provides the following information in table format:

Click to expand E-file invoice table

| Column | Description | Example |

|---|---|---|

rnc_modified_time |

The timestamp of when the invoice was created. | 2025-06-04 18:04:45 |

ripplenet_payment_id |

The unique payment identifier. | b3137e0d-3865-43d2-8d2e-bd6195799ac3 |

sender_end_to_end_id |

A unique ID that the originator specifies. It persists on all Ripple Payments instances that participate in the payment. | e0671e724f1c4393a4b31c13a04a87e6 |

customer_name |

The name of the invoiced customer. | ExampleCustomer |

payment_state |

The state of the payment that is invoiced. | COMPLETED |

invoice_currency |

The currency of the invoice. | USD |

send_amount |

The amount that the payment originator sent. | 3 |

converted_amount |

The amount that was converted (after factoring in total_fee). |

1.49 |

destination_currency |

The currency in which the beneficiary was paid out. | MXN |

destination_amount |

The amount that was paid to the beneficiary. The destination amount is exchanged from the converted_amount (1.49). |

28.53 |

variable_fee |

The variable fee for the transaction. The variable fee is calculated as converted_amount (here $1.49) x rate (bps) and varies by payout corridor. |

0.01275 |

fixed_fee |

The fixed fee for the transaction. | 1.5 |

total_fee |

The total fee for the transaction. The total fee is calculated as variable_fee + fixed_fee. |

1.51 |