Ripple Payments Direct

Ripple Payments Direct allows you to connect to Ripple as a payments provider. By using Ripple Payments Direct, you have a direct financial arrangement with Ripple for cross-border fiat payment services. Ripple takes care of delivering payments to beneficiaries, managing payout partners, providing funds to payout partners, and paying charges in exchange for payment delivery to the beneficiaries. With Ripple set up as a payments provider, you no longer need to buy, sell, or own XRP.

Note:

Ripple Payments Direct offers the RippleNet Home platform for creating payments.

For detailed information, see RippleNet Home.

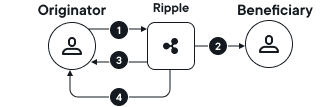

Data flow

Ripple Payments Direct's data flow is simple:

- You - the payment originator - provide Ripple with payment instructions through RippleNet Home .

- Ripple ensures that your selected beneficiary receives the funds.

- RippleNet Home shows you key events as your payment moves through the different stages of its lifecycle.

- Once the payment is complete, Ripple adds the payment transaction to your invoice.

For more information on payment instructions and RippleNet Home events, see Send an individual payment and Send a batch payment.

Features

Ripple Payments Direct provides the following features:

- Onboarding - Simplified customer onboarding experience and general cross-border payment process.

- No crypto - No need to hold or manage cryptocurrency.

- Payment network - A network of payout partners for last mile payment delivery on optimized payment paths to reach a beneficiary.

- Compliance - Guarantee that transactions are compliant with local and national regulations.

- Auto-retry - The system retries payments on your behalf.

Use cases

Ripple Payments Direct's preview version supports treasury payments and business-to-business (B2B) use cases where you can transfer funds to a foreign bank account for example for:

- Payroll

- Liquidity management for subsidiaries

- Vendor/supplier payments

Example use case

The following example describes a payment transaction with Ripple Payments Direct.

Turbo Sophisticated, a company headquartered in the US, wants to do their worldwide payroll from their bank account in the US. The payroll includes employees in Germany and Vietnam.

- Using RippleNet Home , Turbo Sophisticated's payroll administrator initiates a payment with USD as the payment currency and Germany as the destination country, which automatically selects EUR as the payout currency.

- Ripple provides Turbo Sophisticated with a quote and once they accept the quote, Ripple moves those funds to the company's bank accounts in Germany on the company's behalf.

- Once the transaction is complete, Turbo Sophisticated can then pay out their employees in EUR .

- Turbo Sophisticated's payroll administrator then initiates another payment, following the same steps as described previously, except that the destination country is now Vietnam and the payout currency VND .

Prerequisites

To use Ripple Payments Direct, you need to complete the following prerequisites:

- Sign a contract with Ripple to get access to the payments system and network.

- Get started with Ripple Payments Direct using RippleNet Home , which enables transaction creation and settlement and tracks status, events, and user activity.

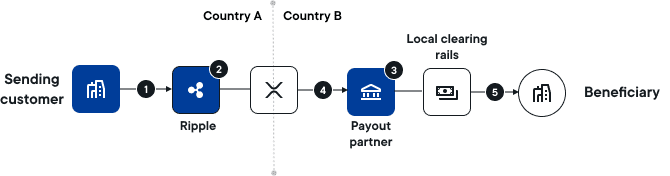

Payment flow

The following diagram represents a Ripple Payments Direct use case with three RippleNet nodes:

- You, the sending customer (node 1), enter payment information in RippleNet Home .

- The intermediary, Ripple (node 2), validates the transaction. If both the risk and compliance checks are successful, Ripple approves the transaction.

- The payout partner (node 3) now validates the transaction. If their compliance checks are successful, they approve the transaction.

- XRP is moved and converted to the destination currency for distribution by the payout partner.

- The payout partner completes the payment by sending the funds to the beneficiary.